UNDERSTANDING YOUR REAL ESTATE TAXES

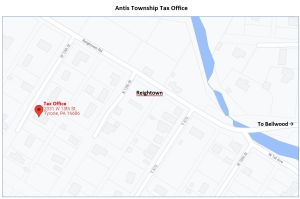

All owners of real estate in the township are required to pay real estate taxes to the Township, Blair County, and the Bellwood-Antis School District. All real estate taxes in Antis Township are collected by the elected tax collector, Stephanie Pennington. (Note that the tax office is no longer housed in the Antis Township Municipal Building, but in the home office of the new tax collector at .)

What Is a Mil?

One mil is equal to $1 of tax for every $1,000 of assessed property value.

WHO COLLECTS REAL ESTATE TAXES?

Antis Township Elected Tax Collector

Stephanie Pennington

2331 West 13th Street

Tyrone, PA 16686

Phone: 814-505-3392

Note the new address and phone number.

WHO LEVIES REAL ESTATE TAX?

Bellwood-Antis School District

School tax bills are sent out in July and are due as follows:

- 2% discount if paid by August 31

- Full amount if paid by October 31

- 10% penalty applied if paid after October 31

If you are a Homestead or Farmstead homeowner you are eligible for the installment plan. There are 3 installments. If you pay in installments, you will not qualify for the 2% discount, even if all installments are paid before August 31. Instructions for opting-in to the installment plan are at the bottom of your bill or you contact the Bellwood-Antis School District. Acceptable forms of payment include cash, check or money order. Real estate taxes not paid by December 31 will be submitted to the Blair County Tax Collection Bureau for collection.

Blair County

County tax bills are sent out in March. For more details, visit the Blair County Assessment Office. Township and County tax bills are sent out in the beginning of March, and are due as follows:

- 2% discount if paid by April 30

- Full amount if paid by June 30

- 10% penalty applied if paid after June 30

Antis Township

Antis Township tax bills are sent out at the same time as the county in March. Overall, the township’s share of your annual  real estate taxes is a small fraction of your total tax bill, accounting for less than 5% of your annual total.

real estate taxes is a small fraction of your total tax bill, accounting for less than 5% of your annual total.